Tags

Alternative Minimum Tax, CLASS Act, corporate tax cuts, deficit reduction, economic growth, Gang of Six, marginal tax rates, Medicaid, Medicare, Obama, overseas profits, Pentagon, Social Security, spending caps, supply side

President Obama was quick to endorse the latest deficit reduction plan, the one from the so-called “Gang of Six” released yesterday, calling it a “very significant step” and “broadly consistent with the approach he has advocated.” This without knowing the details. But the details weren’t really important, because all the major elements are indeed consistent with what the president wants in this deficit reduction shell game.

* Medicare, Medicaid, and Social Security cuts.

* Further cuts in the top marginal income tax rates. (So much for that pledge to let the Bush tax cuts expire).

* Corporate tax cuts.

* The continuation of Reaganomics and Bushonomics. That would be the supply-side, tax cuts equals increased revenue and economic growth nonsense that we all know works so well.

The broad strokes of the “Gang of Six” plan (and just as an aside I wonder why Sen. Sanders is never included in any of these gangs? Not bi-partisany enough, I assume) are as follows:

An immediate $500 billion “down payment” on deficit reduction. All spending cuts, all from unnamed programs. A brilliant idea in a recession. The other $3.2 trillion in savings would be decided by various committees at some later date, enforced by spending caps. Congress would be required to get a 2/3 vote to exceed those caps. IOW, when the next recession hits, anybody looking for any assistance is SOL. David Dayen at Firedoglake:

“Simply put, this is a recipe for depression. When the economy suffered and stimulus would be required to increase aggregate demand, the 2/3 vote needed would simply put a stop to it. The New Deal would have been out of order under this regime. Same with the Recovery Act. Any spending from the federal government would be restricted as much as it is in the states. So there could only be the status quo or contraction in fiscal policy in the event of a recession, which is a perfect way to create a depression.”

Also in the down payment would be the institution of chained CPI, aka a cut in SS benefits, and repeal of the CLASS Act, which was a part of health care reform that the insurance lobby fought tooth and nail. From the New York Times, December of 2009:

“The Class Act, which the late Sen. Ted Kennedy considered his legacy, would allow people to buy long-term care insurance through payroll deductions and to receive cash if they’re later disabled, regardless of their age or of a previous health condition. “This is the best chance the baby boomers have to protect themselves from impoverishment if they need long-term care,” Mr. [Jim] Firman [president of the National Coalition on Aging] said.”

That is Part One. Part Two calls for an additional $200 billion in “healthcare savings,” aka Medicare and Medicaid cuts, and an $80 billion cut in the defense budget. That’s $80 billion over ten years, pocket change for the Pentagon. Gotta love that shared sacrifice.

In Part Two, the Finance Committee…

“…would be required to reduce tax rates to three tax brackets of rates: of 8-12 percent, 14-22 percent and 23-29 percent. The current top marginal rate is 35 percent. The corporate tax rate would be between 23 percent and 29 percent…”

And this little goodie for corporations as well:

“…tax reform would cease taxation of overseas profits.”

The corporate behemoths had been lobbying to get the tax on overseas profits reduced, allegedly under the guise of returning these profits for use in job creation, but that’s not how it worked before:

“Congress and the Bush administration gave companies a similar tax incentive, in 2005, in hopes of spurring domestic hiring and investment.

While the tax break lured 800 companies into bringing $312 billion back to the United States, 92 percent of that was used for dividends and stock buybacks, according to the nonpartisan National Bureau of Economic Research. The study concluded the program “did not increase domestic investment, employment or research and development.”

Indeed, 60 percent of the benefits went to 15 of the largest U.S. multinational companies — many of which laid off domestic workers, closed plants and shifted even more profits and resources abroad in hopes of cashing in on the next repatriation holiday.”

So let’s just eliminate the tax entirely. Nice.

More on the tax “reform” aspects of this plan:

“Coburn said the plan would reduce the deficit by $3.7 trillion over the next 10 years and increase tax revenues by $1 trillion by closing a variety of special tax breaks and havens. He also noted, however, that the Congressional Budget Office would score the plan as a $1.5 trillion tax cut because it would eliminate the Alternative Minimum Tax.”

I’m not sure how that works. How is $1 trillion in revenue increases scored as a $1.5 trillion tax cut? But I know for sure how this works, it doesn’t:

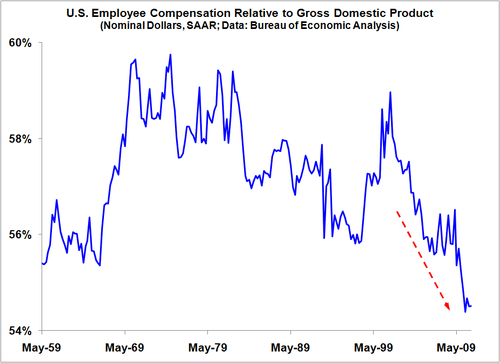

“It would generate a significant amount of revenue out of tax reform and reduction of tax rates, which authors believe would spur economic growth.”

And I believe in the Tooth Fairy and the Easter Bunny.