Tags

alternative energy, Bush tax cuts, China, cloture vote, compromise, create jobs, dog and pony show, House, infrastructure, Kirsten Gillibrand, Mary Landrieu, Mitch McConnell, President Obama, Republicans, Senate, starve the beast

The Senate voted 83-15 yesterday to invoke cloture on President Obama’s sell-out compromise on the extension of the Bush tax cuts for the top 2%. Nine Democrats and Bernie Sanders voted “no.” The nine were: Jeff Bingaman (NM), Sherrod Brown (OH), Russ Feingold (WI), Kirsten Gillibrand (NY), Kay Hagan (NC), Frank Lautenberg (NJ), Pat Leahy (VT), Carl Levin (MI), and Mark Udall (CO). One of the poster children for duplicity and hypocrisy, Mary Landrieu of Louisiana, who previously said that the deal “borders on moral recklessness,” voted “yes.” I’m shocked.

“For Mr. Obama, the Senate vote offered affirmation that his administration had made the most of what seemed to be a rough political predicament, in which it was [BS Alert] forced to negotiate a tax agreement with the Bush-era tax cuts set to expire at the end of the month and Congressional Republicans empowered by their big victory in the midterm elections.

“This proves that both parties can in fact work together to grow our economy and look out for the American people,” Mr. Obama said.”

Absolutely. Those tax cuts have done such a wonderful job growing the economy in the past decade, no reason to expect that won’t continue for the next decade and beyond. Oh, but I forgot. The president is going to fight to end these cuts in two years. And if you’ll buy that….

“Mr. Obama said he understood that there were lawmakers unhappy with parts of the plan on both sides of the aisle, and he and his aides have made clear in recent days that he [BS Alert, Part Two] still fiercely disagrees with the Republicans over extending the lower tax rates on annual incomes above $250,000 per couple or $200,000 per individual.”

Co-president Senate Minority Leader Mitch McConnell is also pleased:

“This bipartisan compromise represents an essential first step in tackling the debt — because in keeping taxes where they are, we are officially cutting off the spigot,” Mr. McConnell said in a floor speech.”

Cut off the spigot, aka starve the beast. Straight out of the Grover Norquist playbook for making government so small it can be drowned in a bathtub.

Don’t expect the final outcome in the House to be any different, after the dog and pony show, that is:

“By all indications, the anger and opposition to the deal among House Democrats shows no sign of abating. At the same time, however, House Dem leaders have sent very clear signs that despite their own unhappiness with the deal, they believe it would be irresponsible to sink the compromise and have no intention of thwarting the President’s will.

Here’s the challenge for House Dem leaders right now, as I understand it: Come up with a way for Dem members to vent their disapproval of the deal, so they don’t feel too stiffarmed and marginalized by the process, without it resulting in changes significant enough to cause Republicans to walk away.”

Heavens no. Let’s be sure we don’t do anything that might piss off the Republicans. Appeasement at all costs.

“The result could be a situation in which Dems hold a vote on amendments to the bill that are likely to fail… Dem leaders could hold a vote amending that provision, allowing Dem members to register disapproval. But the amendment would likely be opposed by almost all Republicans and some moderate Dems. So it would likely lose.”

Like I said. Dog and pony show.

Sen. Gillibrand had this to say:

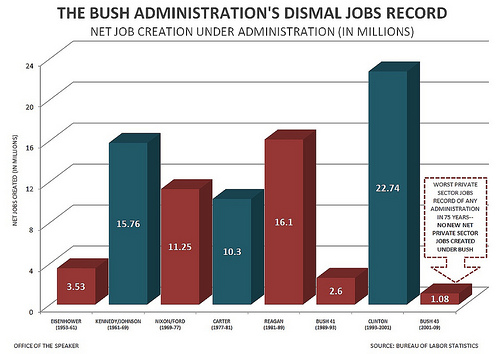

“Although this deal includes important measures I have fiercely advocated for, extending Bush tax cuts for the very wealthy will saddle our children with billions of dollars of debt. With unemployment near 10 percent and a growing budget deficit, every dollar in this deal should be spent in a way that creates jobs and gets our economy growing, and tax cuts for millionaires and billionaires do not create jobs and will not help our economy grow.”

Creating jobs and getting the economy going. Not with more trickle-down bullshit, but the way China is doing it. Yes, China:

“The Chinese have doubled their spending on education – with stunning results – and continue to build the world’s best infrastructure. Reuters reports that Beijing is contemplating a plan to invest $1.5 trillion over the next five years in seven crucial industries. The targeted sectors are alternative energy, biotechnology, new-generation information technology, high-end equipment manufacturing, advanced materials, alternative-fuel cars, and energy-saving and environmentally friendly technologies…While China spends its money to invest in long-term growth, it lends us cash so that we can give ourselves [well, not all of ourselves, just the chosen few] one more big tax break. Someone in Beijing must be smiling.”

Not just smiling, laughing.